Inspirational People- From City Banker to Charity CEO

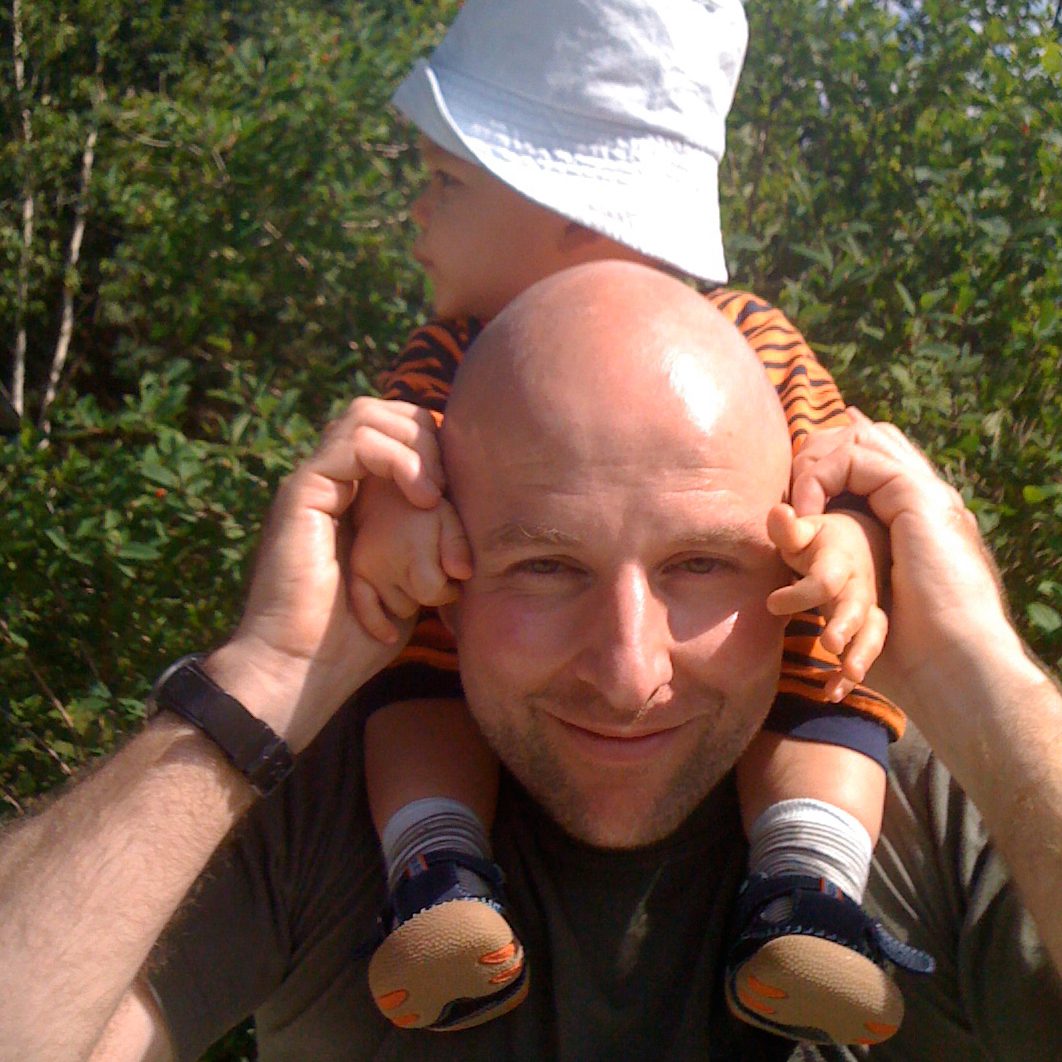

“Mental salvation,” Jean-Marc tells me when I ask why he left his banking job to run a charity full time. He talks about his dismay at the practices in the City in the run up to the crisis. Then he tells me about his son.

“It was that moment, really, that made me look at my life and make a change,” he says. “Until then, it is sometimes hard to find the courage. But when I left before he woke up and returned home to find him asleep, I realised that there is one thing in life that you can never reclaim: time.

“I wrote a list of things I wanted to achieve, things I really wanted to do with my life.

“I think now they call it a bucket list,” he laughs. “I looked over that list and nothing had to do with my job. Not one thing.”

Inspirational People

Jean-Marc is not your typical banker – or then again, perhaps he is. He speaks with a French accent, interrupted occasionally by a Thai parrot that swoops into his garden while he practices martial arts. He’s the CEO of Greenshoots, a microfinance company, and he also contributes to several other projects involving working with AIDs victims and building schools in Cambodia.

“Mental salvation,” Jean-Marc tells me when I ask why he left his banking job to run a charity full time.

He spent a year as a volunteer with VSO before entering the fast-paced, lucrative world of the City. So he manages to crush both stereotypes: that of the starving aid worker and the heartless city banker. I’ve contacted him to find more about GreenShoots.

The Green Shoots Foundation

What does the Green Shoots Foundation do?

Green Shoots aims to fuel organic growth through providing micro-finance to some of the poorest people in the poorest parts of the world. There are some places, especially in sub-Saharan Africa and regions of Asia, where people have no access to banks at all.

Maybe in the light of the recent financial crisis you may think that’s a good thing…

I was just going to say…

…but in reality we are talking about absolute basics. About borrowing the money to buy a simple farming tool, or seeds to grow vegetables or a sewing machine. That’s micro-credit, that’s one aspect.

There’s also micro-savings and micro-insurance, both incredibly important for farmers.

A lot of people have questions about charging interest to people in these situations.

There are a lot of myths about microfinance. One is that we do or we should provide loans for free. Interest-free loans are very, very dangerous because we want to stimulate the spirit of enterprise and empower people. We want them to be able to take their future in their own hands.

Interest-free loans? We cannot do that, it would distort the fundamental rules of the market. What we offer, though is a fairer, much cheaper solution than the alternative: the loan shark.

There have been stories recently about suicides, particularly in India, when people cannot repay their loans. That is not what we do. We set fair rates to people who can repay them.

It’s a fine line, though, isn’t it? Running a charity and charging interest to the people you serve through that charity. How do you decide how to set your rates?

We set our rates to allow Green Shoots to be a stable organisation. If we become a loss-making institution, it will not help. Yet the costs of arranging a $500 000 loan are the same as a $150 one. In fact, often they are less. The person applying for the $500 000 loan will always have a telephone line, a postal address, internet access. The clients we serve…often our members must travel for days to reach them.

We set our rates as low as possible to cover costs. It usually works out at 30%, which shocks people here in the West, but you must remember that the costs are high and that this still saves people from the loan sharks.

I wrote a list of things I wanted to achieve, things I really wanted to do with my life. I looked over that list and nothing had to do with my job. Not one thing.

So, if someone donates to Green Shoots, where does the money go?

We have an option to donate whereby 100% of costs go to charity, not to administration. With more donations, we can provide lower interest rates.

Without credit reports, the electoral register, bank slips and all the other trappings of 21st century banking life, how do you assess someone’s reliability?

We target the women. No, don’t quote me on that. No, I’m teasing, you can. Research has shown that women are more careful with money because they have more to lose if they do not look after their families.

Do you ever turn anyone down for a loan?

Yes, but not often. And usually that is because they already have another loan through another company and we are worried that the repayments will overhwelm them.

What advice do you have for anyone who wants to do the same thing?

Learn how to live with a lot less money. It is easier than it sounds. And remember that you can never reclaim your time. Once it has gone, it has gone forever.

When you told your colleagues in investment banking that you were leaving to run an aid project, what was their reaction?

I think most of them understood. I think many would do the same but the routine and the money…it takes a lot of courage to break that cycle. For me, that came with my son.

Jean-Marc is not your typical banker – or then again, perhaps he is.

Do you miss your former job?

That’s the easiest question you’ve asked me. No. Not at all. Not one bit.

He pauses.

I miss my colleagues. I had the great pleasure of working with some very hard-working, intelligent people who had so much integrity.

And did you get to do everything on that list you wrote that night?

Yes. Some I have loved, like building a school in Cambodia and training in martial arts in Thailand.

However, I also wanted to learn to play the electric guitar. And I tried but…he breaks off…clearly, there are some things we are not meant to do.